Mexico at a glance: a growing, import‑reliant market

- Market size and growth: (2023 = $64.1M); projected (2027 = $94M) at (8.5%) CAGR.

- B2B share: ~68% of value, growing faster than the category.

- Import dependence: ~65% of volume is imported; key sources include China (~42%), Malaysia, Thailand, and the U.S.

- Competitive landscape: fragmented—Top 5 brands hold ~32%; no single brand >15% share.

- Material mix: Natural latex leads (~38.2%); nitrile is the fastest riser from a smaller base.

- Price bands: Economy (<$3.50) ~40%; Mid ($3.50–$5.99) ~42%; Premium (>$6.00) ~18% and the fastest growing (+12.5%).

- Priority verticals:

- Hotels & restaurants (~$14.2M; +11.2%): durability, wet grip, oil resistance, food‑adjacent assurance.

- Food processing (~$10.8M; +9.8%): compliance, puncture/chemical resistance, stable supply.

Compliance basics you’ll need:

- Tariff: HS 4015.19; base duty ~7.5%; China preferential ~3.2%; VAT (IVA) 16%.

- Labels: Spanish mandatory—materials, size, use/care, warnings.

- Food‑adjacent: reference NOM‑003‑SSA1‑2006.

What B2B buyers need—and why projects stall

We work with brand owners, wholesalers, private labels, and retail buyers every day. Across Mexico, four themes recur:

- Consistency batch‑to‑batch: thickness, feel, color, and logo clarity must match—returns and shelf reviews depend on it.

- Ready compliance: Spanish artwork and complete import packs prevent customs holds and launch delays.

- Realistic scaling: flexible MOQs to pilot SKUs and mixed‑SKU containers to balance inventory across sizes/colors.

- A clean Good/Better/Best ladder: clear performance steps that map to Mexico’s price bands without SKU bloat.

Common pain points we hear in Mexico:

- Short service life—fingertips and palms wear through quickly, driving complaints and rebuys.

- Poor wet grip in kitchens and housekeeping; slippage increases risk and slows teams.

- Over‑high MOQs for tests/new colors; difficulty consolidating containers.

- Incomplete paperwork and slow updates triggering port delays and stockouts.

We recognize these aren’t “nice‑to‑have” frustrations; they’re margin‑eaters. Our organization is built to remove them.

How we solve it: depth in manufacturing, disciplined QC, OEM speed

About us:

- Guangzhou Red Sunshine Co., Ltd.—20+ years manufacturing latex and nitrile gloves for household and light industrial use.

- Footprint & scale: legacy plant in Foshan; new facilities in Guangxi and Hebei; 12 automated lines; 300+ staff; 20+ molds spanning 26–55 cm lengths, multiple weights, linings, and colors.

Quality and compliance you can audit:

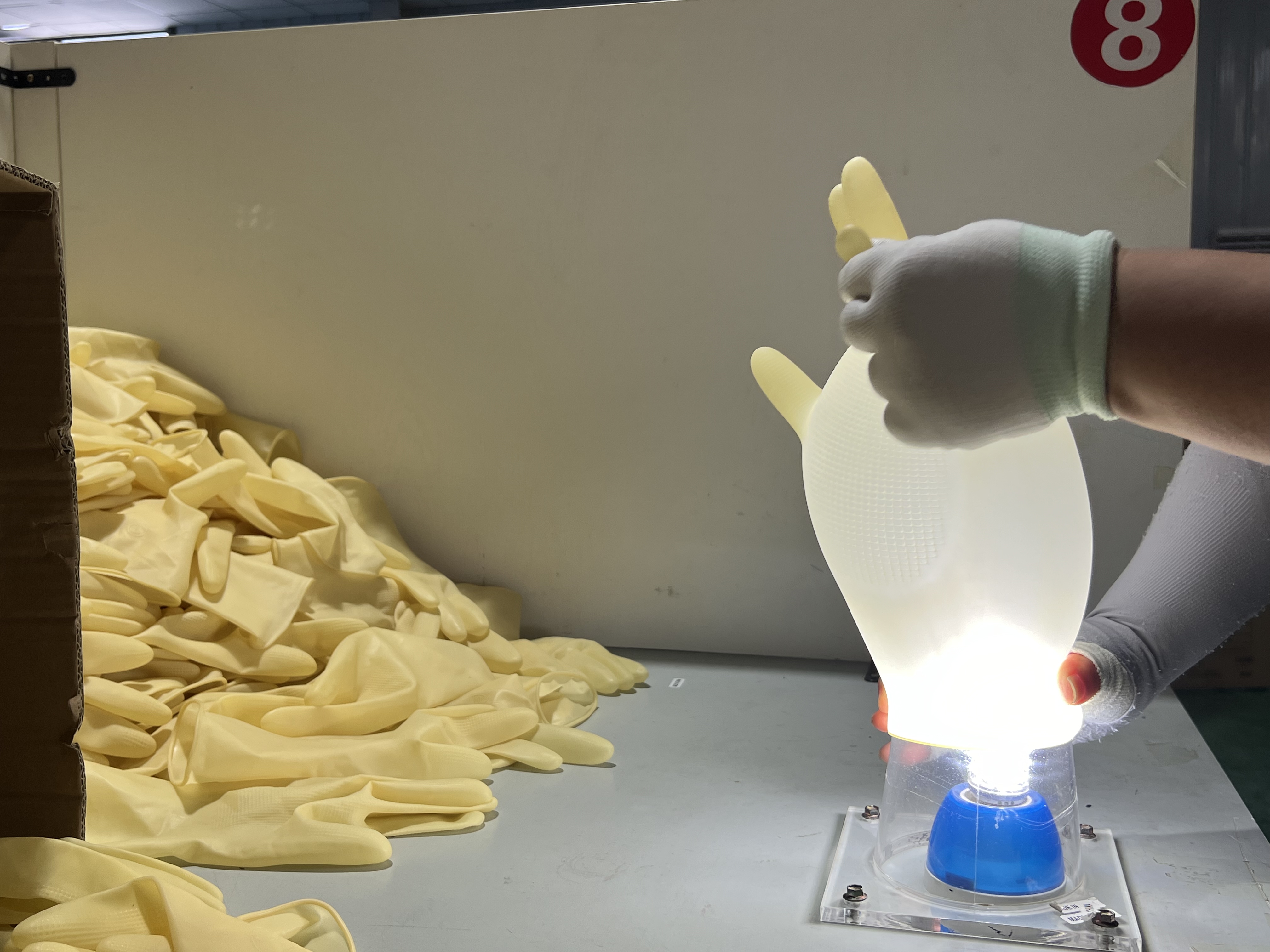

- 5LQC quality control: on‑site inspection + full inspection where needed + carton weighing (count assurance) + pre‑shipment sampling + sealed retention samples.

- Certifications/Testing: ISO, BSCI; CE/KFDA/JFDA/FDA test support.

- Process strengths: high‑quality ceramic molds; veteran technicians (30+ years); optional chlorine treatment for stable donning and finish.

OEM speed and flexibility:

- Flexible MOQs by matching SKUs to different lines; mixed‑model loading to optimize freight.

- “7‑7‑7” path: glove samples ~7 days; packaging plate ~7 days; packaging sample ~7 days.

- Go‑to‑market support: product photos, simple design, and video assets to accelerate sell‑in.

A tiered portfolio for Mexico: Good / Better / Best

Economy “Good” (<$3.50)

-

- Latex 26–31 cm; with/without flock lining; value weights; practical colors.

- Example catalog SKUs:

RHY‑26(26 cm, unlined),RHY‑30(30 cm, unlined),RHF‑29(29 cm, flock‑lined). - Benefits: competitive landed cost, fast replenishment, Spanish packaging ready.

Core “Better” ($3.50–$5.99)

-

- Latex 31–38 cm; embossed palms/fingertips; flock lining for comfort; curated colorways.

- Example SKUs:

RHX‑31/RHX‑31‑2(31 cm),RHH‑32‑2(32 cm),RHH‑33(32–33 cm),RHH‑38(38–39 cm). - Benefits: stronger wet grip, longer wear life, visibly better finish—ideal for chain retail, B2B distributors, and e‑commerce bundles.

Premium “Best” (>$6.00)

-

- Latex long cuff 45–55 cm; heavier weights; optional cotton lining for longer shifts.

- Example SKUs:

RHH‑45(45 cm),RHY‑45(45 cm),RHH‑55(55 cm). - Benefits: extended splash coverage and a clear upgrade narrative for hotels, jan‑san, and back‑of‑house kitchens.

Latex‑free extension (nitrile) for sensitive users and oil‑prone tasks:

NLH‑33‑13: 13 mil, 33 cm, 55 g (M), latex‑free, 4 colors; custom logo.NLG‑32‑11: 11 mil, 32 cm, 45 g (M), latex‑free, 8 colors; custom logo.

Color and packaging tuned for Mexico:

- Vibrant yet professional color coding for on‑site zoning (kitchen vs. bathroom) and shelf navigation.

- All packaging localized to Mexican Spanish—materials, size, use/care, allergy notes, and importer details.

Route‑to‑market: from pilot to national roll‑out

Channel priorities:

-

- B2B distributors (~32% share; +12.4% growth) for hotels, jan‑san, and food processing.

- Large retail chains (~28%; +8.2%) to anchor the “Better” tier and seasonal promos.

- E‑commerce (~18%; +15.6%) with color bundles and size kits.

- Traditional wholesale (~22%; −2.1%) to defend entry‑level price points.

Low‑risk onboarding plan:

- Spec & compliance alignment (within 72 hours)

- Confirm HS 4015.19 duty scenario, Spanish labels, NOM references, target price bands, and performance benchmarks.

- Pilot kit (7–14 days)

- Good/Better/Best samples, wet‑grip and water‑leak protocols, Spanish packaging mockups for internal approvals.

- Trial order (20k–30k pairs)

- Mixed‑SKU loading across lengths/weights/colors; firm production window, milestone updates, and pre‑shipment photos.

Documentation and visibility:

-

- Complete import packs; Spanish artwork; test summaries.

- Sealed retention samples and QC checkpoints to support audits and tenders.

What success looks like for Mexico’s B2B buyers

- Broader coverage with fewer SKUs and a clean trade‑up logic across Economy/Mid/Premium.

- Predictable quality—stable feel, thickness, color, and branding backed by 5LQC controls.

- Faster launches via “7‑7‑7” sampling, ready Spanish assets, and disciplined communication.

- Lower capital risk through flexible MOQs and mixed‑model containers.

- A defendable story for enterprise buyers with sealed retention samples and test documentation.

Call to action

Planning a Mexico launch or supplier transition? Share your target price bands, preferred lengths/linings, and monthly volumes. We’ll map a Good/Better/Best assortment for your channels, ship a pilot kit within days, and align a mixed‑SKU trial order with full Spanish compliance.

Let’s build a durable, compliant, and profitable latex glove line for Mexico—together.

Click and jump into WhatsApp ↓